Wu Xinming, Deputy Secretary of Nantong Municipal Committee and Acting Mayor, visit Nantong Reshine New Material Co., Ltd.

On February 9th, Wu Xinming, deputy secretary of the Municipal Party Committee and acting mayor, led the principal responsible comrades of the Municipal Bureau of Industry and Information Technology, the Human Resources and Social Security Bureau, the Bureau of Commerce and the Health and Health Commission to visit Reshine, accompanied by Wang Kai, deputy mayor, Ling Yi, secretary of the municipal government, Zhang Jianhua, secretary of the Party Working Committee of the Municipal Economic and Technological Development Zone, and Bao Delin, director of the Municipal Economic and Technological Development Zone Management Committee.

Mayor Wu visited Reshine production workshop. Zhang Xinlong, Secretary of Reshine CPC Party branch and General Manager of Reshine, introduced Reshine's production and operation, products and production technology, development planning to Mayor Wu.

Mayor Wu encouraged Reshine to continuously intensify innovation and research, extend the industrial chain, and constantly improve the quality and efficiency of development. At the same time,Mayor Wu required ETDZ and relevant departments to focus on new energy industry, accurately complement, enhance and extend its value chain, so as to add surging power for the high-quality development of Nantong economy.

Ministry of Industry and Information Technology: In 2035, China's public vehicles will be fully electrified.

On May 25th, the Ministry of Industry and Information Technology had previously formulated the Action Plan for Promoting Electrification of Vehicles in Public Fields, which is now being vigorously promoted.

According to relevant plans, by 2035, China's public vehicles will be fully electrified, and fuel cell vehicles will be commercialized. To this end, the Ministry of Industry and Information Technology is prepared to further promote electrification in buses, urban logistics vehicles and on-road sweepers.

It is understood that the authorities will start the declaration of comprehensive electrification pilot cities, and work with the Ministry of Finance and other relevant departments to study the incentive and subsidy support policies, so as to effectively promote private consumption through electrification in the public sector.

Regarding the above measures, Sun Hengzheng, an expert on new energy vehicles, said that due to the particularity of public vehicles, this comprehensive electrification pilot project will require the perfection of local charging and replacing facilities. The expert further pointed out that different vehicles, such as official vehicles, network cars, taxis, buses and logistics vehicles, have different requirements for charging and replacing batteries, and more suitable methods must be considered in combination with the operating characteristics of vehicles, such as slow charging, fast charging, battery swapping, high-power charging and online charging. The design of vehicles in public areas should be combined with charging and replacing methods to obtain the best economy and efficiency.

"This national pilot project, regardless of the number of participating cities, will greatly expand the number of EVs and the scale of charging and replacing power stations." Sun Hengzheng said.

Article from: auto.Gasgoo.com

Reshine New Materials was awarded the certification of organization and product carbon footprint by TV Rheinland

On January 16th, Nantong Reshine New Material Co., Ltd. obtained the certificate of carbon emission and product carbon footprint certification of the organization. The certificate was issued by TüV Rheinland, an international independent third-party testing, inspection and certification organization. This certification lays a data foundation for the enterprise to accurately formulate green and low-carbon strategies and implement carbon reduction programs.

At present, global climate change and environmental pollution are worsening, and the promotion of “carbon peak, carbon neutral” has become a global consensus, and low-carbon products are increasingly recognized by the international and domestic markets. Carbon emission verification is equivalent to a “carbon physical examination” of Reshine, which is a comprehensive assessment of its greenhouse gas emissions and offsets, and is one of the important indicators for measuring its environmental performance. Based on the results of the carbon inventory, Reshine can design emission reduction measures, set scientific carbon targets, disclose carbon information and manage carbon assets.

On the basis of the carbon inventory of the organization and products, Reshine has formulated a carbon management work plan, deeply analyzed the business operation and production process, and continuously improved the process technology. By improving energy efficiency, promoting the use of renewable energy, optimizing supply chain management and other measures, Reshine continues to practice low-carbon development path, aiming to bring customers products with both superior performance and low-carbon characteristics.

In the future, Reshine will actively respond to the commitment of “double carbon” goal, adhere to technological innovation, continue to explore effective ways to improve the efficiency of battery materials, and practice low-cost, low-carbon, high-efficiency product technology, and benefit customers and the society as soon as possible, and actively promote sustainable development, contributing to the construction of a zero-carbon planet.

April LIB data release: NCM materials growth slowed down, high nickel proportion reach new high in history

Chinese power battery market in April maintains a high degree of prosperity, although the year-on-year growth rate is amazing, compared to March it is relatively stable, the growth rate slowed down, the mainstream enterprises basically maintain saturated production, the space of capacity utilization rate increase is limited.

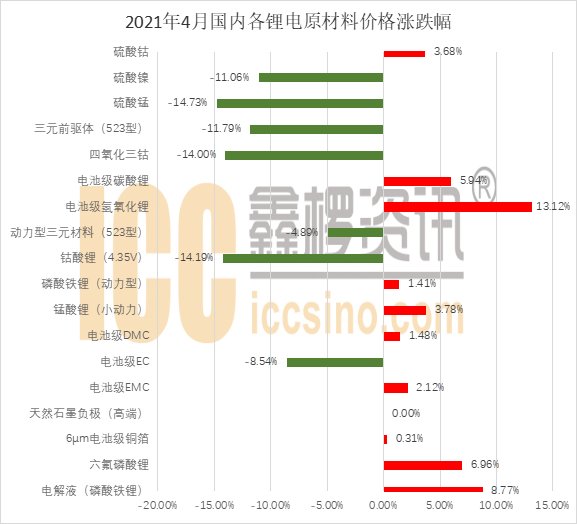

Price: by the fluctuations of the macro international environment and the difference of product's own supply and demand pattern, the price trend of domestic LIB materials in April significantly differentiated, of which lithium hexafluorophosphate, electrolyte, lithium salts, and other products rose in the lead; While NCM precursor, cobalt tetraoxide, as well as lithium carbonate and other materials declines. (Source: China Automotive Power Battery Industry Innovation Alliance)

數(shù)據(jù)來源:中國汽車動力電池產(chǎn)業(yè)創(chuàng)新聯(lián)盟

CAM | Domestic CAM production growth slowed down in April

According to ICC LIB database, in April, the total output of the four major domestic CAM were 77,800 tons, an increase of 123.8% yoy, and a 4.0% increase month-to-month. Among which, the output of NCM materials was 29,800 tons, an increase of 116.3% yoy and 6.1% mtm; the output of lithium iron phosphate was 27,600 tons, an increase of 212.0% yoy and 6.2% mtm; lithium cobalt oxide was 0.81 million tons, a decrease of 8.7% yoy, and lithium manganese oxide was 12,300 tons, an increase of 3.8% yoy.

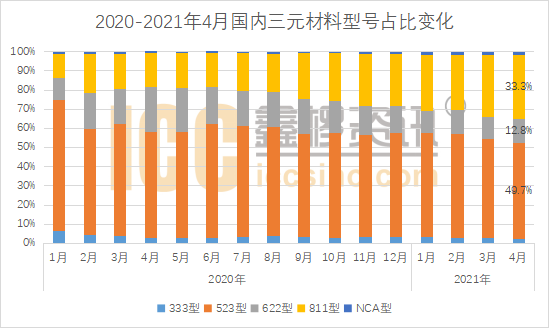

CAM| high nickel to continue strong Ni8x market share set a new high

According to ICC LIB database, in April the domestic high nickel NCM production increased considerably, the total amount exceeded 10,450 tons for the first time, reaching 10,450 tons, an increase of more than 300% yoy, and a small rise of 9.3% from the previous year. Accompanied by the release of high-nickel NCM, the domestic market share of high-nickel NCM in April has reached 35.1%, of which the Ni8x market share reached 33.3%, and from the future production arrangements of each manufacturers, the share of high-nickel NCM will continue to rise.

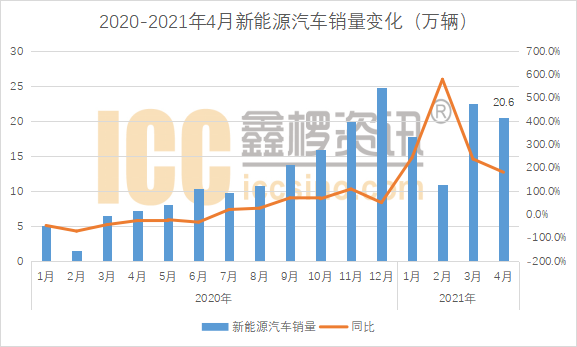

New Energy Vehicles | China Association of Automobile Manufacturers (CAAM): Domestic sales of new energy vehicles in April is 206,000 units, an increase of 238.9% yoy.

According to the China Association of Automobile Manufacturers (CAAM) data: in April 2021, domestic new energy vehicle sales is 206,000 units, an increase of 1.8 times; of which 171,000 units of pure EV sales, an increase of 2.2 times; PHEV sales reach 35,000 units, an increase of 70.8%. Jan.-April cumulative sales is 732,000 units, an increase of 2.5 times.

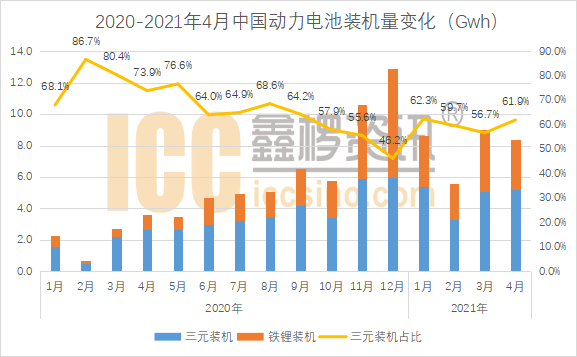

Power Battery| Installed capacity of domestic power battery in April was 8.4GWh, up 224.8% year-on-year

According to the China Automotive Power Battery Industry Innovation Alliance: in April 2021, China's power battery installed capacity totaled 8.4GWh, up by 134.0% yoy. NCM batteries, LFP batteries installed capacity are respectively 5.2GWh and 3.2GWh, up by 97.3% and 244.5% yoy.

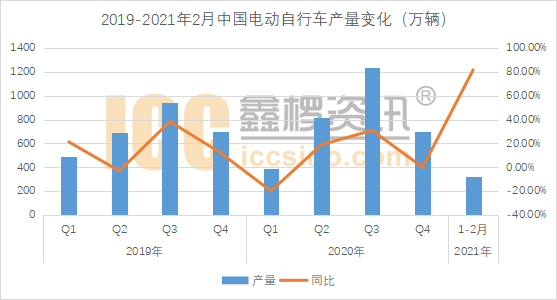

Small power battery | January-February domestic production of 3.185 million e-bike, up by 81.7% year-on-year.

According to data from the Ministry of Industry and Information Technology (MIIT), in January-February 2021, the domestic production of e-bikes was completed at 3.185 million units, up by 81.7% yoy.

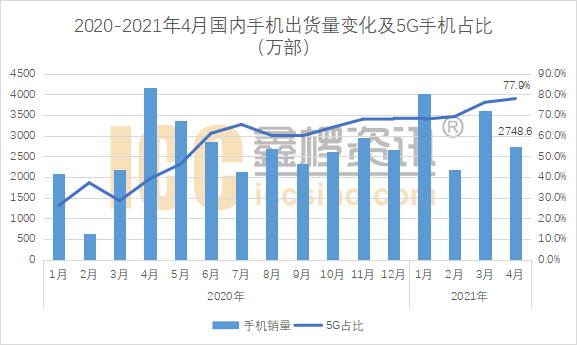

3C Digital | Domestic cell phone shipments of 27.486 million units in April, with 5G accounting for 77.9% of total shipments

According to China ICT, in April 2021, the overall domestic cell phone shipments amounted to 27.486 million units, down by 34.1% yoy; among them, the domestic 5G cell phone shipments amounted to 21.42 million units, accounting for 77.9% of the cell phone shipments during the same period. during the period of January-April, the overall shipments in the domestic cell phone market totaled 125 million units, an increase of 38.4% yoy.

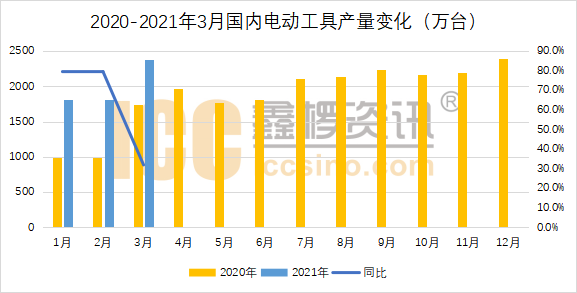

Power Tools | Domestic Power Tools Output of 60.158 Million Units in Jan-Mar, Up 59% yoy

According to the National Bureau of Statistics (NBS), in January-March 2021, the domestic production of electric handheld tools amounted to 60.158 million units, a year-on-year increase of 59%.

With the introduction of the American Clean Energy and Security Act , the new energy EV market boom to be re-enforced

The introduction of the American Clean Energy and Security Act , stimulus beyond expectations

On May 26, 2021, the U.S. Senate Finance Committee passed the proposal of American Clean Energy and Security Act :

1) a total of approximately $259.5 billion in clean energy tax credit programs, of which $31.6 billion is for EV consumer tax credits; at the same time, provide manufacturers with a 30% tax credit to help manufacturers reorganize or build new factories and incentives for manufacturers to purchase commercial EV.

2) Raise the current $7,500/vehicle tax credit cap with an additional $2,500/vehicle for which assembled in the U.S., and an additional $2,500/vehicle whose manufacturer is union-represented, raising the single-vehicle credit cap to $12,500; however, this would only apply to EVs priced at $80,000 or less.

3) Relax the 200,000-vehicle limit for automakers to receive tax credits, and also provide $100 billion in consumer rebates; the tax credits would be rolled back over three years when the U.S. sales penetration rate for new energy vehicles reaches 50%.

The proposal still needs to be passed by the Senate and the House of Representatives.

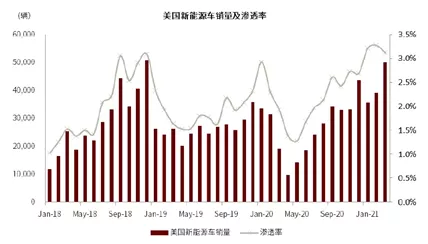

The proposal subsidy strength exceeded market expectations, focusing on its proposed subsidy regression endpoint is the penetration rate of 50%. And January-April 2021, the U.S. EV penetration rate was only 3.1%, significantly lower than Europe 14.9%, China 9.8%. If the policy falls into place, the U.S. market in 2022-2023 is expected to replicate Europe's 2019-2020 market development path, leading to a new round of global growth.

Source: EV-sales, CICC, 2021/05

Boosted by this news, today (May 31) new energy vehicles related stocks rose strongly again. By the close of trading, the CS New Energy Vehicle Index tracked by the New Energy Vehicle ETF (516660) rose 4.88%.

Figure: CS New Energy Vehicle Index rose 4.88%

Data source: Wind, as of 2021/05/31

U.S. Big Subsidy era will start, taking over the global new energy vehicle policy cycleOn the policy cycle, China has entered the post-subsidy era, the marginal effect of the policy is weakening, and private consumer demand is driving the release. European carbon emissions strong pressure + high subsidies continue, new energy vehicle demand is strong, maintain high growth. And the United States since Biden came to power, new energy vehicle policy support efforts exceeded expectations, entering the era of large subsidies, take over the global new energy vehicle policy cycle, or make the United States become the next high-growth region.

Source: Industrial Securities, 2021/05

The electrification of international automobile enterprises speeds up again, and the Chinese industrial chain is expected to benefit

Driven by policy and consumers' intrinsic demand, the electrification transformation of international automobile enterprises may speed up again. 2021, GM, Ford, Volvo and other large international OEMs have announced their electrification goals, and plan to stop selling traditional fuel vehicles after the designated year. Volkswagen, Honda and other car makers have also made a lower limit on the proportion of their future pure EV sales planning. More car companies may join in the future, and the trend of automotive electrification transformation is further clarified.

Table: Summary of new electrification targets of international car companies since 2021

Huge vehicle electrification demand, China's LIB material suppliers leading in technology and cost may fully benefit. Take the United States as an example, at present, besides Tesla's 10GWh capacity (still test line not MP), there is no local battery suppliers. LG Chem, SKI and other Japanese and South Korean battery makers in the future will become the main supplier of U.S. battery. And many Chinese LIB materials companies due to technology and cost leadership, as part of LGC, SKI and Tesla supply chain, are expected to benefit from the depth of the global new energy vehicle industry's rapid growth.

New Energy Vehicle High Prosperity Continues, Focus on New Energy Vehicle ETFs

Not only the international market potential high demand for new energy vehicle industry chain in the future, the Chinese new energy vehicle sales also continue to maintain a high boom. According to the data of the passenger car association, in April, the retail sales of new energy passenger cars reached 163,000 units, +192.8% yoy, wholesale sales of 184,000 units, +214.2% yoy, to maintain a high growth trend. The penetration rate for that month was 10.1%, and the January-April penetration rate was 9.0%, which is significantly higher than the 5.8% penetration rate in 2020.

Sales in May, according to Shenwan Hongyuan Scecurities, the industry's overall demand is still in a booming state, the new energy market is expected to be around 160,000 terminal retail sales in May, compared with April or basically flat. In the short term, the lack of chips may bring some disturbance, but it believes that with the gradual alleviation of the chip problem in the second half of the year, the market demand may be further released, and it is still optimistic about the possibility of higher growth throughout the year. (Note: third-party forecast data for reference only, not as investment advice)

In this regard, it is recommended to pay attention to the new energy car ETF (516660), focusing on the current high boom core track, covering upstream resources, lithium materials, batteries, charging piles, vehicles and other new energy car industry chain investment opportunities.

Previous:Mineral supply chain due diligence management policy

Next:The Ministry of Industry and Information Technology: 2035 China's public sector vehicles will be fully realized electrification

2023

Nantong Reshine New Material Co., Ltd. completed A round of financing;output hit a record high, among the ten billion enterprises industry.

May 2020

Jinchuan Group Co., Ltd. carried out a second capital increase to Hunan Reshine reaching 67% shares.

In June 2018

Lanzhou Jinchuan Science and Technology Park Co., Ltd. inject capital to Hunan Reshine as to holding 34% shares.

In 2016

Nantong Reshine New Material Co., Ltd. and Jinchuan Group Co., Ltd. jointly established a precursor joint venture (Lanzhou Kington Energy Storage Power New Materials Co., Ltd.)

In Nov. 2006

Nantong Reshine New Material Co., Ltd. was established.

In May 2001

Hunan Reshine New Material Co., Ltd. was established.

高性能單晶動力鎳鈷錳酸鋰正極材料開發(fā)與產(chǎn)業(yè)化

中國有色金屬工業(yè)科學技術(shù)獎(一等獎)_00

2021年度安全先進集體(開發(fā)區(qū))