新聞資訊

The introduction of the American Clean Energy and Security Act , stimulus beyond expectations

On May 26, 2021, the U.S. Senate Finance Committee passed the proposal of American Clean Energy and Security Act :

1) a total of approximately $259.5 billion in clean energy tax credit programs, of which $31.6 billion is for EV consumer tax credits; at the same time, provide manufacturers with a 30% tax credit to help manufacturers reorganize or build new factories and incentives for manufacturers to purchase commercial EV.

2) Raise the current $7,500/vehicle tax credit cap with an additional $2,500/vehicle for which assembled in the U.S., and an additional $2,500/vehicle whose manufacturer is union-represented, raising the single-vehicle credit cap to $12,500; however, this would only apply to EVs priced at $80,000 or less.

3) Relax the 200,000-vehicle limit for automakers to receive tax credits, and also provide $100 billion in consumer rebates; the tax credits would be rolled back over three years when the U.S. sales penetration rate for new energy vehicles reaches 50%.

The proposal still needs to be passed by the Senate and the House of Representatives.

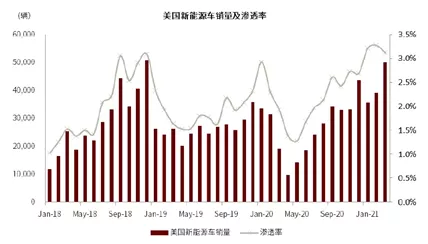

The proposal subsidy strength exceeded market expectations, focusing on its proposed subsidy regression endpoint is the penetration rate of 50%. And January-April 2021, the U.S. EV penetration rate was only 3.1%, significantly lower than Europe 14.9%, China 9.8%. If the policy falls into place, the U.S. market in 2022-2023 is expected to replicate Europe's 2019-2020 market development path, leading to a new round of global growth.

Source: EV-sales, CICC, 2021/05

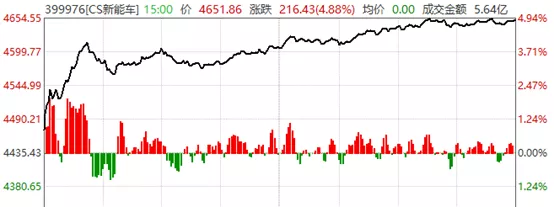

Boosted by this news, today (May 31) new energy vehicles related stocks rose strongly again. By the close of trading, the CS New Energy Vehicle Index tracked by the New Energy Vehicle ETF (516660) rose 4.88%.

Figure: CS New Energy Vehicle Index rose 4.88%

Data source: Wind, as of 2021/05/31

On the policy cycle, China has entered the post-subsidy era, the marginal effect of the policy is weakening, and private consumer demand is driving the release. European carbon emissions strong pressure + high subsidies continue, new energy vehicle demand is strong, maintain high growth. And the United States since Biden came to power, new energy vehicle policy support efforts exceeded expectations, entering the era of large subsidies, take over the global new energy vehicle policy cycle, or make the United States become the next high-growth region.

Source: Industrial Securities, 2021/05

The electrification of international automobile enterprises speeds up again, and the Chinese industrial chain is expected to benefit

Driven by policy and consumers' intrinsic demand, the electrification transformation of international automobile enterprises may speed up again. 2021, GM, Ford, Volvo and other large international OEMs have announced their electrification goals, and plan to stop selling traditional fuel vehicles after the designated year. Volkswagen, Honda and other car makers have also made a lower limit on the proportion of their future pure EV sales planning. More car companies may join in the future, and the trend of automotive electrification transformation is further clarified.

Table: Summary of new electrification targets of international car companies since 2021

Huge vehicle electrification demand, China's LIB material suppliers leading in technology and cost may fully benefit. Take the United States as an example, at present, besides Tesla's 10GWh capacity (still test line not MP), there is no local battery suppliers. LG Chem, SKI and other Japanese and South Korean battery makers in the future will become the main supplier of U.S. battery. And many Chinese LIB materials companies due to technology and cost leadership, as part of LGC, SKI and Tesla supply chain, are expected to benefit from the depth of the global new energy vehicle industry's rapid growth.

New Energy Vehicle High Prosperity Continues, Focus on New Energy Vehicle ETFs

Not only the international market potential high demand for new energy vehicle industry chain in the future, the Chinese new energy vehicle sales also continue to maintain a high boom. According to the data of the passenger car association, in April, the retail sales of new energy passenger cars reached 163,000 units, +192.8% yoy, wholesale sales of 184,000 units, +214.2% yoy, to maintain a high growth trend. The penetration rate for that month was 10.1%, and the January-April penetration rate was 9.0%, which is significantly higher than the 5.8% penetration rate in 2020.

Sales in May, according to Shenwan Hongyuan Scecurities, the industry's overall demand is still in a booming state, the new energy market is expected to be around 160,000 terminal retail sales in May, compared with April or basically flat. In the short term, the lack of chips may bring some disturbance, but it believes that with the gradual alleviation of the chip problem in the second half of the year, the market demand may be further released, and it is still optimistic about the possibility of higher growth throughout the year. (Note: third-party forecast data for reference only, not as investment advice)

In this regard, it is recommended to pay attention to the new energy car ETF (516660), focusing on the current high boom core track, covering upstream resources, lithium materials, batteries, charging piles, vehicles and other new energy car industry chain investment opportunities.

Previous:Mineral supply chain due diligence management policy

Next:The Ministry of Industry and Information Technology: 2035 China's public sector vehicles will be fully realized electrification